Several situations will move you in the position of hiring personnel in China. Hiring personnel in China has enormous benefits in any China-related sector. Especially compared to hiring the same positions in Europe or US. In another situation, you will need to employ local Chinese employees if you are opening an office or manufacturing plant in China. In both cases, hiring personnel in China requires awareness of pro’s & con’s and what subjects are important to consider. We have tried to emphasise some key topics below.

Chinese local entity/company registration (WFOE)

To hire employees legally in China you will need a local Chinese company entity. Employees need to be registered on an official, by government issued, business license of a locally registered company. Therefore, for foreigners, to hire personnel in China legally you would need to set up a WFOE (Whole Fully Owned Enterprise) or Representative office within China.

Solution to a local Chinese entity without official registration

CIL China offers to opportunity to hire personnel in China without any company registration or obligations. By hiring employees in China on the business registration of CIL China, you avoid obligations of registering your local company, paying taxes or fulfil to local company tax laws in China. In this solution, your employee(s) can make use of CIL China’s office facilities, warehouse and operational infrastructure.

Also, your employee will work in an office where it gets the full support of colleagues and foreign management. By hiring employees and place them within CIL China, you get access to make use of CIL China its business infrastructure, local network, local resources, experience and knowledge. Creating a productive and profitable environment for your employee(s) and business activities in China.

Local HR resources and platforms

Job seekers in search for a job are mostly moving themselves on Chinese job platforms. Examples of popular job platforms are “51job” and “Zhilian Zhaopin”. For recruiters, these job platforms are closed for the public and are paid to use. Certain service packages and credits/points need to be bought to be able to search, select and contact job seekers on these platforms. Costs will be made to be able to contact possible candidates without a guarantee of success.

Because China’s (business) culture is, in general, existing out of closed communities and contacts, open vacancy databases or other free to use job platforms do not really exist. Certain open platforms and databases are rising recently. However, the popularity and therefore success rate of finding a candidate is still quite low compared to other platforms.

A limited number of candidates

To hire personnel in China, you first need to find suitable candidates for your position. For office functions with specific requirements such as speaking a second language (English or Spanish) in combination with experience in a particular sector, the number of candidates can be limited. Therefore, finding suitable candidates for your positions can be difficult and time-consuming. Especially if you don’t know what exactly you are looking for and where exactly these candidates can be found.

High rotation of employees

Employees in China usually are not always that loyal to their employer. “Money” and “Career” are the biggest objective of an average worker and therefore also the speed at which they can collect as much as possible money and promotions are essential.

Also, the general “Millennial labour force issue” of having no patience or having the feeling of not developing fast enough is very present. These influences create the situation that in China and Hong Kong when paying average salaries, it is commonly seen that employees often switch from jobs if the grass is judged greener at the other side. Hiring personnel in China is therefore always expected to have a high rotation level of employees. In average, personnel stays mostly about 1 – 2 years. Employees who remain at a company more than four years can be already judged as loyal.

Social security and insurance

In China, companies are required to pay social securities and insurance for every employee hired. That means all your personnel are insured for basic health care and for the contribution to the social facilities of the country. When social insurance is bought for a company its personnel, the employee receives a health insurance card. This card is proof of insurance and is also able to be used as a payment card to pay for medicines up till a certain amount.

The employer is required to pay social insurance for every employee in the company. There are several social insurance rates related to specific salary amount categories. The higher the income, the higher the social insurance amount that needs to be paid for an employee to the related government organisation.

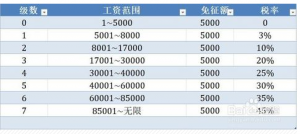

Personal income taxation in China

Employees and companies should pay local government taxes over labour. In China, income tax is charged both partly on employee and employer side. However, the actual payment of income taxes over a salary is normally the obligation of the employer/company.

Tax rates on income are calculated based on the salary amount minus conductions. Since the new regulations of 2018, Salaries lower than 5000 CNY/RMB are charged with 0%, so not charged at all. Only social insurance will take a small part of the salary to be paid.

Current personal income tax rates of China for local Chinese employees.

Bookkeeping

Having Chinese employees means you will need a Chinese company entity. (Unless you make use of CIL China’ solution). The general accounting of the office and its employees are in addition to that included. Payment of salaries, bonuses and taxes need administrative work, and costs/profit need to be accounted.

Hours need to be noted, bonuses need to be calculated, and taxes need to be paid to the government tax bureau. Having Chinese employees require therefore a sufficient amount of bookkeeping work and obligations because of the governmental laws on labour. Therefore, hiring Chinese personnel means that you will need to hire an administrator/bookkeeper or outsource this work to consulting companies.